2024

A year in review

“Normalization” was perhaps the word of the year in travel, but the industry also saw much that was out of the ordinary, from shattered revenue records to company collapses.

Looking back at Travel Weekly’s top stories of 2024, the most dominant theme wasn’t exactly the most gripping: normalization.

That mostly referred to a return to what more closely resembled prepandemic travel and booking behaviors. “Normal” no longer had a “new” in front of it.

But there was nothing normal about some of the biggest stories we followed, like American Airlines backing down from its controversial NDC policy, or the cruise industry’s historically strong financial performance after having been the industry hit hardest by the pandemic.

As in any year, the highs came with lows. The failed JetBlue-Spirit merger led to a Chapter 11 filing from Spirit last month. American Queen Voyages suddenly went out of business during a month that also saw the closure of longtime tour packager Gogo Vacations. Crisis-plagued Boeing started 2024 with a near-disaster. Extreme reactions to overtourism made headlines. And the travel industry said goodbye to quite a few of its most notable figures.

Finally, 2024 was a year of artificial intelligence innovation. And while travel advisors may not be known as early adopters of technology, AI’s potential has been too good to ignore.

AA’s NDC about-face

For ASTA, the story couldn’t have been scripted better.

In May, on the eve of the Society’s annual Travel Advisor Conference, American Airlines said it would reverse course on its controversial distribution strategy that had made more than half of its content available only to agencies booking with NDC. The carrier would later say its push for direct bookings could cost it $1.5 billion in 2024 revenue.

ASTA CEO Zane Kerby speaking at the Society’s conference in Dallas. ASTA notched a win against American Airlines’ NDC strategy. (Courtesy of ASTA)

ASTA CEO Zane Kerby speaking at the Society’s conference in Dallas. ASTA notched a win against American Airlines’ NDC strategy. (Courtesy of ASTA)

For ASTA, the about-face was a victory after its very public and bitter campaign against American’s policy, the Society’s largest to date in terms of engagement. Thousands of advisors and clients wrote to lawmakers urging change, while ASTA leadership publicly assailed the airline in letters to the DOT and DOJ and in op-ed pieces in major newspapers.

The cherry on ASTA’s cake may have been that it could take its victory lap in Dallas, where its conference landed this year — home to American’s headquarters. That same week, Vasu Raja, the carriers’ chief commercial officer and architect of its NDC distribution strategy, also announced his resignation.

The reversal was a shot in the arm for a travel trade that for many years has been spurned by the airline industry. Or as ASTA CEO Zane Kerby succinctly said, it was a “testament to the firm position that travel agencies hold in the airline distribution channel.”

The Spirit saga

In November, Spirit Airlines filed bankruptcy, just one year after the carrier was preparing for a $3.8 billion acquisition by JetBlue. In January, the Justice Department prevailed in its lawsuit to block the union when a federal court struck down the merger. At first the airlines appealed, but not seeing a path to approval, they gave up in March.

A Spirit Airlines jet. The airline filed for bankruptcy last month. (Courtesy of Spirit Airlines)

A Spirit Airlines jet. The airline filed for bankruptcy last month. (Courtesy of Spirit Airlines)

It was the end of a long saga that began with Frontier and Spirit making plans to merge, which JetBlue then bigfooted with a bigger offer. The DOJ had argued that a combined JetBlue-Spirit would harm Spirit’s bargain-hunting customers. Now, those customers are wondering if Spirit will even survive.

Back to normal

Travel Weekly’s annual Travel Industry Survey solidified what hotel brands and travel agencies have been telling us throughout 2024: Travel is normalizing. This year, 65% of agencies in the TIS survey reported bookings growth over the past 12 months, down from 79% in 2023.

It was something we heard again and again from travel executives this year: According to Travel Leaders Network president Roger Block, “We are seeing not softening but leveling off” in terms of bookings; Hyatt Hotels Corp. CEO Mark Hoplamazian cited a “return to prepandemic seasonality” in Mexico and the Caribbean; Sandals Resorts International chairman Adam Stewart reported a “normalization” trend and “more traditional booking behaviors.”

The Sandals Saint Vincent and the Grenadines all-inclusive resort. Sandals Resorts International chairman Adam Stewart is one of several industry executives who have remarked on a normalization trend in the industry. (Courtesy of Sandals Resorts)

The Sandals Saint Vincent and the Grenadines all-inclusive resort. Sandals Resorts International chairman Adam Stewart is one of several industry executives who have remarked on a normalization trend in the industry. (Courtesy of Sandals Resorts)

It’s also something U.S. Travel identified, with CEO Geoff Freeman saying the domestic leisure travel boom that drove the industry for the past few years was “normalizing” but at a “rate substantially higher” than before the pandemic.

“We’ve been a bit drunk on leisure travel as an industry,” Freeman said, “and every good party comes to an end.”

Cruising speed

If there was a travel sector MVP award, 2024’s would go to the cruise industry.

The Big Three cruise companies — Carnival Corp., Royal Caribbean Group and Norwegian Cruise Line Holdings — have taken turns this year smashing records for booking volumes, booked positions, pricing levels, customer deposits, net yields, net per diems and revenue.

Cruises are also booking further out than ever: Norwegian Cruise Line’s Black Friday offer just put 2027 cruises on sale.

Seeing no slowdown, the lines made massive ship orders this year: Major cruise companies — including the Big Three, Disney, MSC and Viking — collectively plan to build more than 40 ships in the next 12 years.

And 2024 saw the debut of one of the most exciting and hyped cruise ships to date: Royal Caribbean International’s Icon of the Seas. Since its naming by soccer superstar Lionel Messi in January, travel advisors say the ship itself gets people who have never cruised before clamoring to set sail. But good luck trying: Royal Caribbean said this summer that the Icon was sailing with a whopping load factor of 132%.

Royal Caribbean International’s Icon of the Seas, which made its debut this year. (Courtesy of Norwegian)

Royal Caribbean International’s Icon of the Seas, which made its debut this year. (Courtesy of Norwegian)

Taming tourism

In July, close to 3,000 Barcelona residents took to city streets, chanting “tourists go home” and, in one incident, shooting water pistols at people dining outdoors.

While extreme, the protesters echoed the sentiments of many people living in popular tourism hot spots around the world who this year forced officials to take action. Barcelona’s mayor this summer said that the city would ban short-term rentals by the end of 2028.

Crowds fill the streets outside the Sagrada Familia basilica in Barcelona. The city saw anti-tourism protests in July. (Photo by Jeff Whyte/Shutterstock.com)

Crowds fill the streets outside the Sagrada Familia basilica in Barcelona. The city saw anti-tourism protests in July. (Photo by Jeff Whyte/Shutterstock.com)

Halfway across the world, a similar measure was approved in Maui. This fall Florence approved a plan to ban key boxes on buildings in its historic city center and the use of loudspeakers by tour guides. And Greece’s prime minister proposed a $22 summer tax on cruise ship passengers to Santorini and Mykonos. In Juneau, after cruise ship traffic jumped 30% from 2019 to 2023, officials limited cruise calls to five ships per day this season and approved a plan to limit them further in 2026.

Voyages’ end

In February, domestic river cruise operator American Queen Voyages (AQV) abruptly ceased operations, citing “unforeseen business circumstances” and the inability to obtain capital to keep afloat.

Its parent, Hornblower Holdings, filed Chapter 11 bankruptcy shortly after and said the cruise line had failed to recover from the pandemic. While abrupt, it wasn’t surprising. Major consortia and packagers had suspended sales of AQV just prior to the closure, citing issues including late commission payments.

American Queen Voyages’ American Empress paddlewheeler. In February, the domestic river cruise operator abruptly ceased operations, citing “unforeseen business circumstances.” (Courtesy of American Queen Voyages)

American Queen Voyages’ American Empress paddlewheeler. In February, the domestic river cruise operator abruptly ceased operations, citing “unforeseen business circumstances.” (Courtesy of American Queen Voyages)

It was a fall from grace for the brand that launched in 2011 with Priscilla Presley naming the 436-guest American Queen paddlewheeler. The line then expanded with the addition of three more river ships and the purchase of Victory Cruises to enter the Great Lakes and ocean cruising business.

American Cruise Lines, the biggest domestic river cruise operator, acquired all four of those AQV ships out of bankruptcy, but unfortunately for their fans, it did not find value in keeping them. Only the American Empress has not been sent to a scrapyard.

AQV was the second big closure news of 2024. Flight Centre Travel Group said in February it would shutter Gogo Vacations, which had been around since 1951, citing the struggling wholesaler model.

AI inroads

According to Travel Weekly’s 2024 Travel Industry Survey, less than two years after ChatGPT’s debut, almost half (41%) of advisors are using AI, a number that leaps to 58% among advisors 45 or younger.

Not bad for a group not exactly known for being tech-savvy.

It seemed the promise of generative AI solutions, improving efficiency and saving time, is too good to ignore. Signature Travel Network began offering members access to TobyAI, an AI platform specifically built for advisors that uses genAI for social media and crafting itineraries. Travel Leaders Network inked a similar agreement with TobyAI in December 2023.

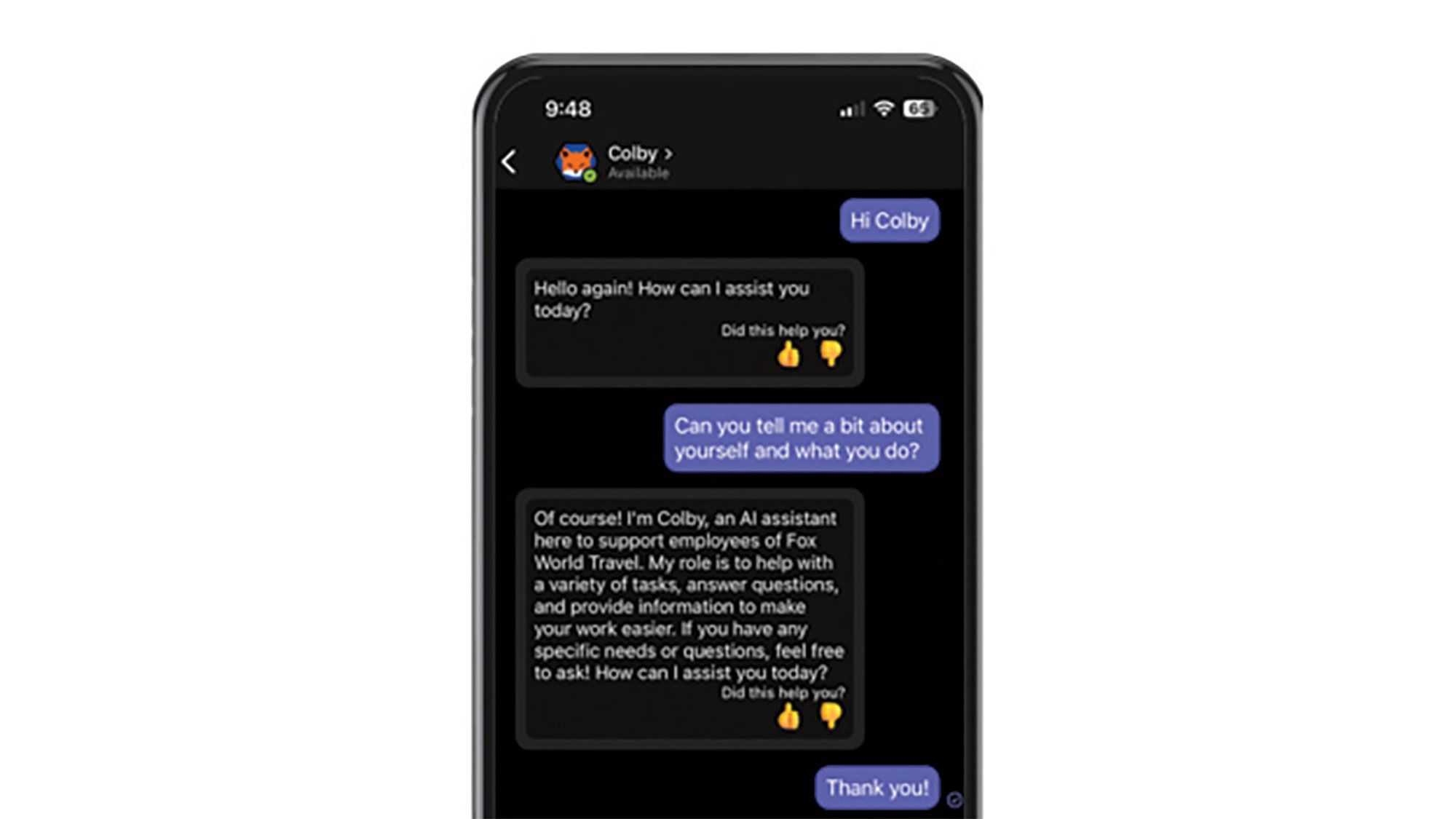

Fox World Travel (No. 32 on Travel Weekly’s Power List) introduced Colby AI, an AI assistant that helps improve workflow, offers data on traveler preferences and helps with booking inquiries and data analytics.

Colby AI is Fox World Travel’s new AI assistant for advisors. (Courtesy of Fox World Travel)

Colby AI is Fox World Travel’s new AI assistant for advisors. (Courtesy of Fox World Travel)

In May, at its annual partner conference, Expedia Group (No. 2 on the Power List) launched Romie, an AI-powered travel assistant. As CEO Ariane Gorin said about AI from the stage, “It’s everywhere. And, yes, at times, it feels like the only thing anyone is talking about. But that’s for good reason.”

Hotel highs

By the end of 2023, ADR had hit record highs across the U.S., Europe and other major markets.

This year, the industry had to wonder how long the party would last.

STR and Tourism Economics revised their U.S. hotel forecast in mid-November, with STR president Amanda Hite warning the sector’s positive momentum could be “potentially offset by the higher cost of living.” ADR is now expected to rise by 1.5% and RevPAR by 1.4%; previously, both were on track to be up by around 2%.

STR president Amanda Hite presents an updated 2024-25 U.S. hotel forecast during the 46th annual NYU International Hospitality Industry Investment Conference on June 3. (Photo by Matt Rickman/Questex)

STR president Amanda Hite presents an updated 2024-25 U.S. hotel forecast during the 46th annual NYU International Hospitality Industry Investment Conference on June 3. (Photo by Matt Rickman/Questex)

The impact of sky-high hotel rates has already given some segments of the industry pause: Tour operators said that European hotels were turning away their group business in favor of more lucrative FIT. Packagers said Hawaii’s surging hotel room rates were causing customers to choose competing destinations such as Mexico and the Caribbean. Even high-end hotels began bundling various inclusions into their nightly rates to appeal to clients looking for more value.

But it also became clear that it will take a lot for hoteliers to give up on the record rates they’ve been able to command. Virtuoso reported that ADR for its preferred hotel network was around $1,500 to $1,700 per night, up about 50% from the prepandemic years. And according to data from CoStar, the number of properties with average room rates of $1,000 or higher grew substantially across the globe this year: In the U.S. alone, the number of properties able to sustain $1,000-plus ADR grew from 22 in 2019 to approximately 80 by the first half of 2024.

Boeing blowout

The year started off with yet another black eye for the beleaguered airplane builder. On Jan. 5, a door plug blew out of an Alaska Airlines Boeing 737 Max 9 shortly after takeoff over Portland, Ore.

Nobody was seriously hurt, but the ensuing investigation would temporarily ground 171 737s and reveal deep issues with Boeing’s assembly and quality control. When the plug was recovered, it was found to be missing all four of the bolts that were meant to keep it in place. Alaska Airlines subsequently discovered loose bolts on “many” of its Boeing 737 Max 9 aircraft.

An Alaska Airlines Boeing 737 Max 9. A door plug fell off one of its Max 9s midair in January, sparking a grounding of the aircraft type and an investigation into Boeing’s manufacturing and quality control. (Courtesy of Alaska Airlines)

An Alaska Airlines Boeing 737 Max 9. A door plug fell off one of its Max 9s midair in January, sparking a grounding of the aircraft type and an investigation into Boeing’s manufacturing and quality control. (Courtesy of Alaska Airlines)

The incident sparked a federal investigation and lawsuits against Alaska and Boeing and a leadership shake-up at Boeing. In May, CEO Dave Calhoun said he would step down, the same month that Boeing agreed to pay $160 million in compensation to Alaska Airlines for the incident.

The impact on the aviation industry extended to other airlines, which said that delayed Boeing deliveries had negatively affected their ability to expand capacity and networks. During the first quarter, Boeing’s airplane deliveries plunged to just 83 from 130 in Q1 2023 amid increased scrutiny of its 737 program. United even said it would pause pilot hiring due to Boeing delivery delays.

Boeing’s woes continued: Its factory workers went on a seven-week strike this fall, costing the company an estimated $50 million per day.

The Taylor Swift effect

The eye-popping impact on destinations of the Beyonce and Taylor Swift tours in 2023 got people talking about the power of events travel, but this year it became a bona fide trend.

“Memorable events are driving travel trends,” the Mastercard Economics Institute’s Travel Trends 2024 report stated in May. The well-documented Taylor Swift effect — approximately $1 billion in additional hotel revenue across the U.S., Europe and Asia this year, according to global real estate services firm JLL — made the biggest headlines. But the Paris Olympics set a record of 12.1 million tickets sold, and during the solar eclipse, hotel sales within the path of totality in the U.S. experienced a 71% boost, Mastercard found.

The Olympic rings installed on the Eiffel Tower in June ahead of the Paris Games. (Photo by Hethers/Shutterstock.com)

The Olympic rings installed on the Eiffel Tower in June ahead of the Paris Games. (Photo by Hethers/Shutterstock.com)

According to the data, young people are driving the trend. In June, an Allianz Partners survey found that nearly one-quarter of Americans were planning to travel for a major pop culture event this summer, but 40% of travelers ages 18 to 34 were planning event travel.

In memoriam

This year saw the passing of many notable figures in the travel industry who leave behind lasting legacies.

Among them were Arthur Frommer, who revolutionized travel publishing with the “Europe on 5 Dollars a Day” guidebook and went on to create a global travel media empire; John Stachnik, who co-founded Mayflower Tours in 1979 and was an advocate for tour operators as two-time chairman of the USTOA; Rainer Jenss, founder of the Family Travel Association, who worked to increase the quality and awareness of family travel experiences; Simon Cooper, whose 50-year career included a decade as president of Ritz-Carlton and leadership positions with Marriott and Delta Hotels; Navin Sawhney, whose 40-year career in travel included CEO of Ponant, the Americas, and executive positions with Holland America Line, Cunard and Tauck; and Scott Ahlsmith, a travel advisor advocate who held positions at Virtuoso and Apple Leisure Group and served as the chairman of the Travel Institute.

The industry lost many notable figures in 2024. Among them, from left, John Stachnik, Rainer Jenss, Navin Sawhney, Simon Cooper, Arthur Frommer and Scott Ahlsmith.

The industry lost many notable figures in 2024. Among them, from left, John Stachnik, Rainer Jenss, Navin Sawhney, Simon Cooper, Arthur Frommer and Scott Ahlsmith.

Jamie Biesiada, Nicole Edenedo, Christina Jelski, Robert Silk and Andrea Zelinski contributed to this report.